A brief overview of Linescale

Linescale® is a product innovation method modeled on expert depth interviewers which predicts customer behavior using new and better psychometrics.

Linescale Method and The Linescale are protected by U.S. Patent no. 7,664,670

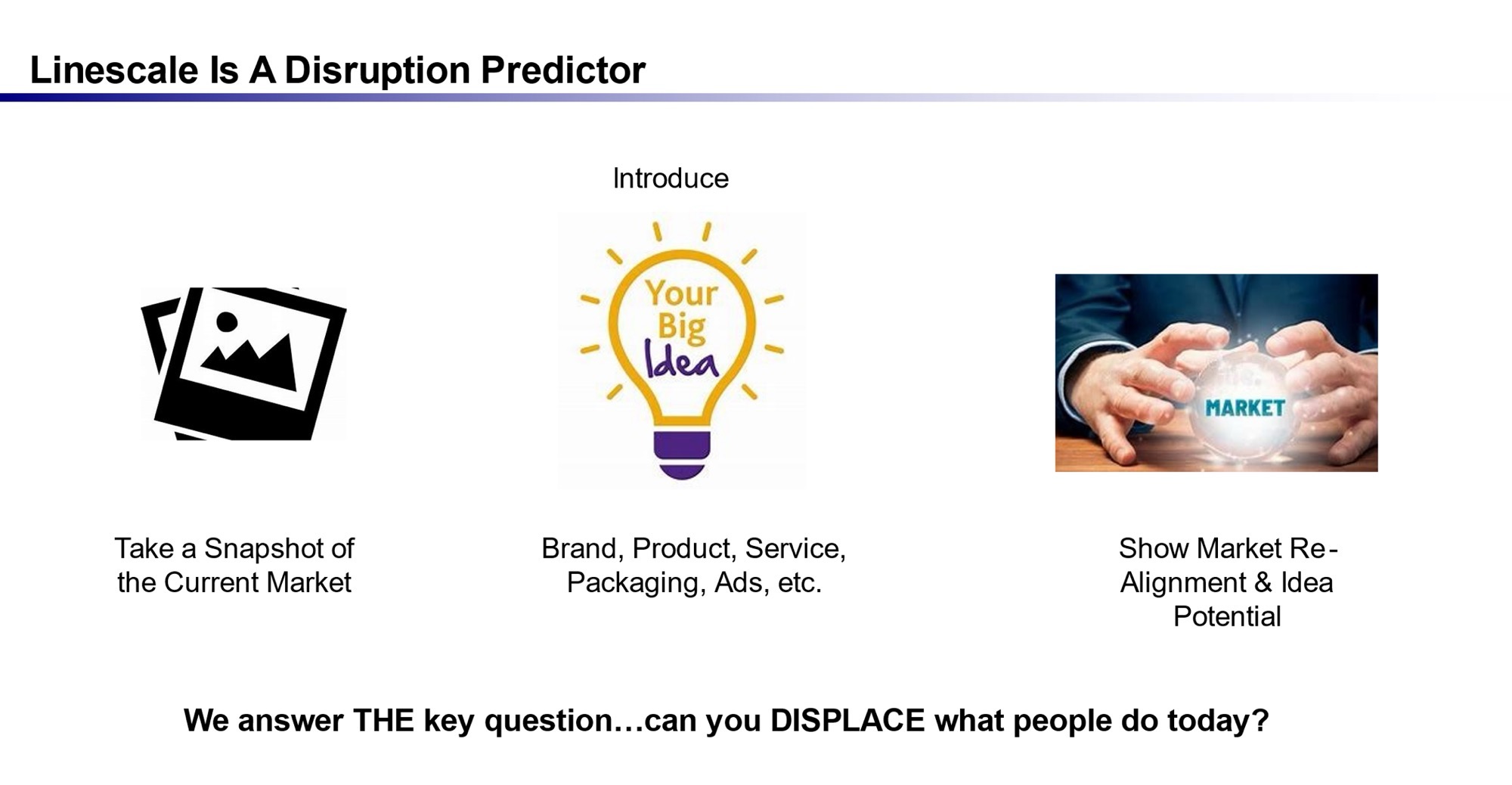

Until the Linescale, there really wasn't a way to measure the competitive context, multi-dimensionality and inertial impact that go into how people make decisions about new products. Researchers did the best they could with the tools they had. We made a custom tool for this specialized task. The Linescale method allows the product developer to emulate depth interviewing affordably and quickly at scale using an expert system. The patented psychometric Linescale delivers quantifiable normative results telling you how your idea will perform in the market, from whom it will take business and why.

It's like an NPS measure for something that doesn't exist yet.

What is a Linescale?

Linescale quantifies the qualitative method.

The face-to-face method used by an expert Individual Depth Interviewer has historically been the best way to "approximate" the future performance of an idea, but the familiar qualitative expert system method is too slow and expensive for quantitative evaluation. It doesn't scale. We needed an expert system that simulated the Depth Interview method at low cost and high speed - i.e. quantify the qualitative method.

We had to create a specialized new psychometric scale to do this. It's unique - the U.S. Patent Office awarded us a patent. It looks like a six-point Likert scale. But it can measure ideas and products in context. How? It's "sticky" and can hold and display previous ratings allowing context-based direct comparisons among many items.

Simple rank ordering by forced choice paired comparison worked fairly well for individual features or benefits, but was a poor predictor of how well or poorly a "whole" complex idea or concept would perform in the market. We learned that each person has their own implicit set of evaluative criteria in mind when they think about why they currently use their favorite products. Decision criteria is both complex and subtle -- too subtle and unique to be measured by traditional quantitative methods. But, we wanted each person to engage their own implicit set of evaluative criteria when evaluating both familiar benchmarks and new ideas - analogous to generating an NPS rating for something not yet experienced. It took a while to get it right.

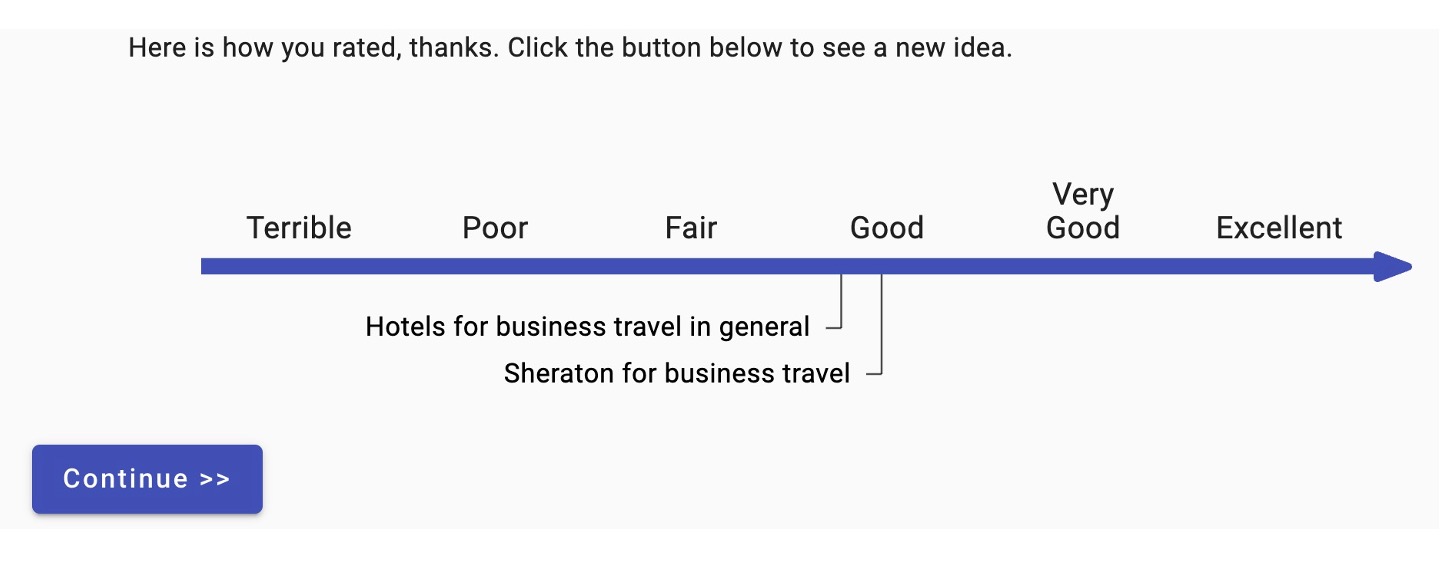

Below is an example of a Linescale after a business traveller identified and rated her usual business hotel and other available alternatives in general. This now presents a familiar competitive context ready for her to evaluate your new idea; relevant and direct paired comparisons using each person's own criteria.

If you're on a phone, turn it landscape...

These ratings become personal benchmarks anchoring their personal evaluative scale.

Now your new idea will be shown and rated twice on this same scale. First, a brief overview for a quick, “thinking fast” evaluation. Then a second exposure with more detail for a thoughtful, “thinking slow” evaluation. Nobel Prize winner Daniel Kahneman taught we have two "Thinking Systems;" an immediate intuitive first impression "Thinking, Fast" — or System 1 thinking. And, a slower, more logical deliberation and evaluation - "Thinking, Slow" — or System 2 thinking. Both are critical to understand how people perceive, think, decide and take action. Understanding both is critical to PREDICT BEHAVIOR.

Direct Competitive Comparison.

High ratings and consumer applause are nice, but you need to know if your product will displace competition, not just whether people like it. ANSWER THE REAL QUESTION: Will they "give up what they are doing today" to get your new idea.

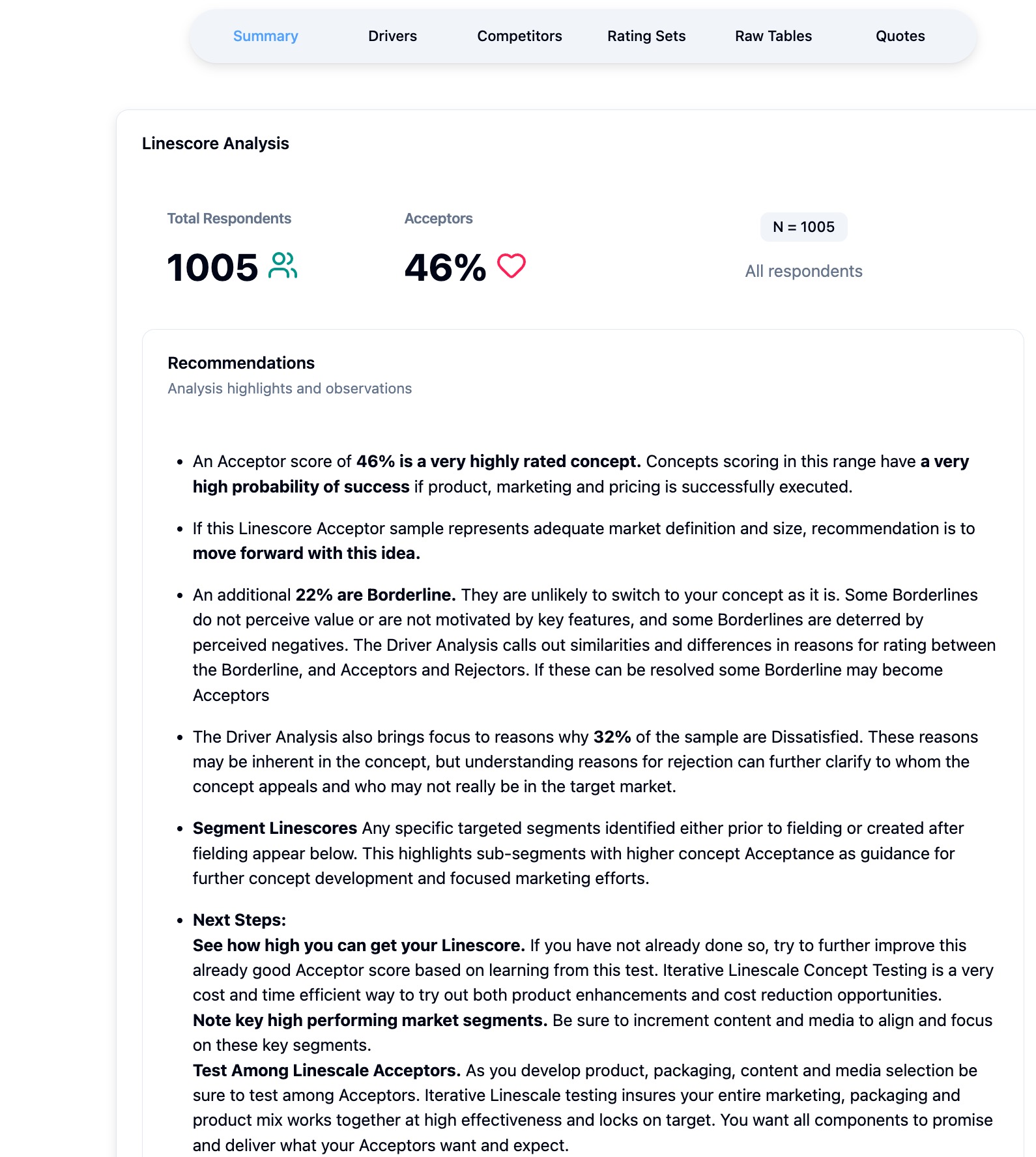

To answer this question, respondents then rate the idea on several other dimensions plus recommendation. Now you have a Benchmarked normative concept test and can identify who and how many are ACCEPTORS or BORDERLINE or INDIFFERENT or REJECTORS of your Brand, Ad, Product, Loyalty/Reward Program or New Idea.

Here is a topline from the online report:

What is an Acceptor?

A Linescale Acceptor is a potential Future Promoter

An Acceptor will choose your brand in place of what they do today IF it is available, marketed and priced appropriately.

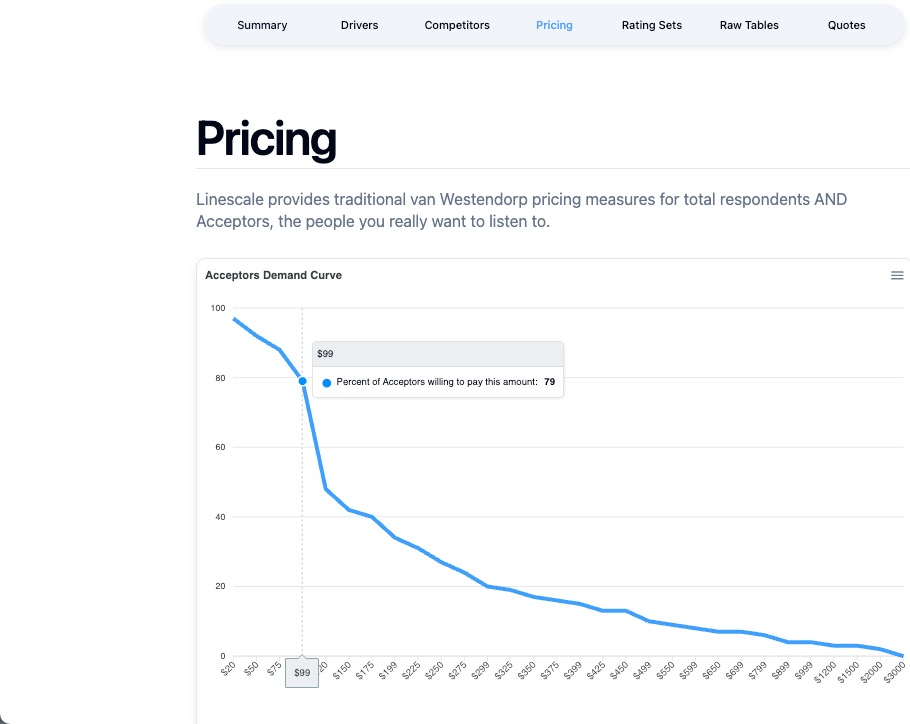

Linescale shows price demand curve among Acceptors

Our proprietary algorithm has been validated over decades with thousands of tests, real-world marketplace results and post market analysis by clients.

What will you learn?

- HOW MANY are Acceptors

- WHO they are

- WHAT their favorite currently is

- WHERE your volume will come from, what brands will you displace

- WHY they prefer you to their favorite

- and, WHAT is driving rejection

- WHAT would it take to turn Borderlines into Acceptors.

Deep Engagement

Each person sees their score and what it means, is asked if they agree or disagree - most agree. Agreement builds commitment. When we ask "WHY this rating?", because engaged, they tell us QUALITATIVELY what was salient, important. Then quantify their reasons by selecting key factors from a list of positive and negative reasons. Driver Analysis lets us contrast Acceptor reasons with Rejectors or Borderlines reasons to QUANTITATIVELY show what's great about your idea, what's weaker, and what needs to change to turn Borderlines to Acceptors. Next steps become clear.

Our clients include...

Linescale Method has been available on a strictly limited basis. We recently developed a more intensive generative AI process allowing us to open our expert system to broader commercial availability. Look for our introduction.

Dan's our CTO and Chief Wizard